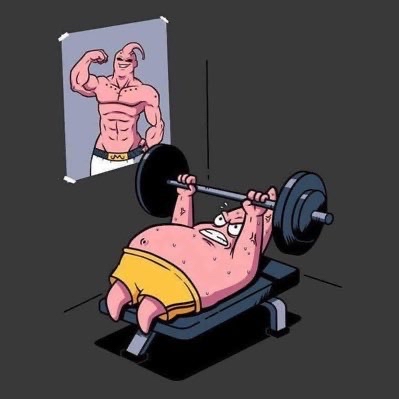

pi從前文提到的要利用借幣鯨魚來為我們拉盤。

這個借幣鯨魚可是聰明的,知道怎麼欺騙投資人。數據顯示,從昨日發文到現在,借幣鯨魚自己壓價又自己買回,更多的散戶拋售給借幣鯨魚回購,讓鯨魚回購了二百萬顆還幣。

並且連槓桿買幣都增加。

投資人不提早建立對抗鯨魚的共識群來利用鯨魚幫我們拉盤,這樣不但pi價格很難起色,也會不斷的看到價格下行。

有些人認為,只需要躺平等待項目方發展,自然有價格。

也是啦,每一次項目方成功發展的話題後,借幣鯨魚就借出超過市場所有買盤資金來打壓,讓所有被認為的機會都成為下行的趨勢。

那麼,你能確定上主網後,鯨魚不會借出夠大的幣來打壓話題產生的買盤嗎?

#PI

各位是否看pi的借幣鯨魚非常的不爽呢?

讓我跟各位投資人報告一件事!

歷史上這個借幣鯨魚全都只在特定交易所上進行借幣。並且,歷史上鯨魚的資金最多將交易所的借幣量借出到最高1100萬顆pi。

現在可以看到借幣數據已經在今日達到980萬顆,若以歷史最大資金量來說,頂多剩下200萬顆的資金可借。

那麼回顧上一次借到1100萬顆的情況是在8月1日的時候造成快速下插將近0.7。

這時可能沒資金而急需回購pi,隨後暴漲到0.46。0.46不但超過了鯨魚回購成本,鯨魚還虧了將近打壓價差的50%。

現在,請關注,借幣鯨魚已經借到最高980萬顆,依照歷史來說他最多就只剩300萬資金,而就算300萬也頂多打壓0.02的流動性價差。

而且該交易所總量只有三千萬顆,並且不是全部可借,也就是說,借幣已經達到上限邊緣。

因此,現在是對抗鯨魚的時機,只要投資人故意拉價,不需要買多,只要能一直故意拉價,最終借幣鯨魚害怕時,就會跟上次一樣快速回購500萬顆來幫投資人拉盤。

各位覺得現在情況如何,急需聽聽各位大佬的看法!

#PI

@CuongHo1811 當我這邊提到借幣鯨魚要出現時,或者提到拋售是鯨魚時,就該注意鯨魚借了多少幣,並評估鯨魚是否還有資金借幣。

我們的機會在於,利用鯨魚來幫我們拉盤。

但是鯨魚也很聰明,他會左手打壓,右手低價二倍數量的回購。創造下行趨勢。

任何策略都不能公開談論

@EvrenKartal10 如果不理解事實,那麼這樣的內容與其他kol無腦購買並無任何差異。

那些kol購買了半年了,何來的資金?

這只會導致鯨魚更清楚知道自己可以打壓價格

18.43K

12

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.